Welcome to "Mastering the Money Game: The Essential Guide to Business Finance" where we will delve into the intricate world of business finance. In today’s ever-changing economic landscape, understanding the principles of business finance is vital for entrepreneurs, small business owners, and seasoned professionals alike. Whether you are an aspiring entrepreneur looking to launch your first venture or a seasoned executive aiming to optimize your company’s financial strategies, this comprehensive guide will provide you with the knowledge and insights necessary to navigate the complex terrain of business finance successfully.

With the ever-increasing importance of finance in the business realm, knowing the ins and outs of business finance is no longer optional but rather a critical skill set for anyone aiming to prosper in today’s competitive market. In this guide, we will cover a wide range of topics, including financial planning, investment strategies, risk management, and more. Through this journey, we will provide you with valuable tools and practical advice that will equip you with the confidence and expertise needed to make informed financial decisions that will propel your business forward.

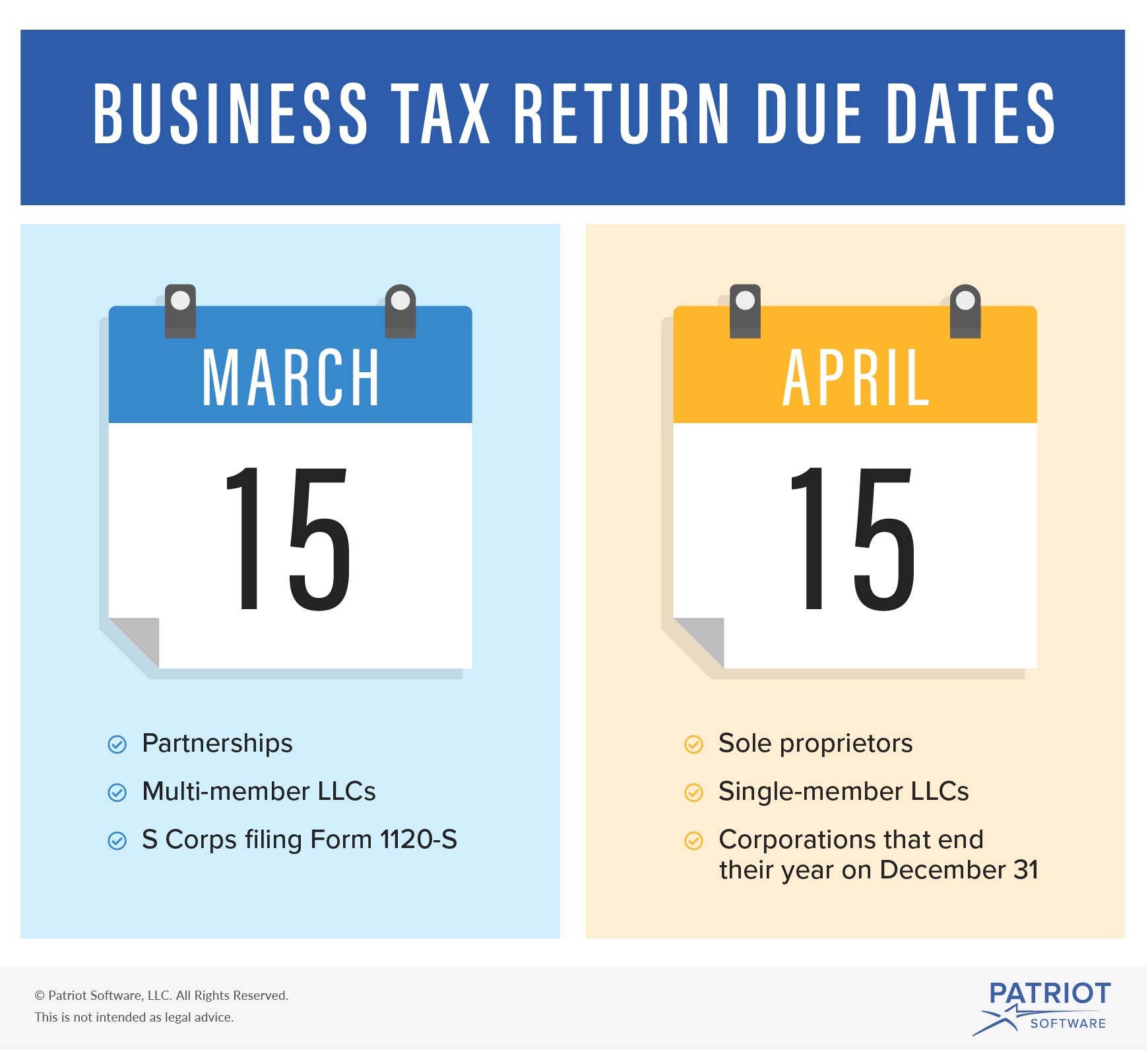

Additionally, we will shed light on the often-overlooked subject of business tax law. Understanding the intricacies of tax regulations is paramount in managing your company’s financial affairs. We will explore the ever-evolving tax landscape and offer insights on how to navigate the complexities, ensuring compliance while optimizing your tax planning strategies.

Whether you are a seasoned finance professional or just beginning your journey into the world of business finance, this guide will serve as your trusted companion, providing you with the necessary knowledge and resources to master the money game. So, let’s dive in and unlock the secrets to achieving financial success in your business endeavors.

Understanding Business Finance

Business finance plays a crucial role in the success of any organization. It involves managing and optimizing the financial resources to achieve the desired goals and objectives. By understanding the fundamentals of business finance, entrepreneurs can make informed decisions and navigate the complex financial landscape. In this section, we will explore the key aspects of business finance and how they impact the overall financial health of a company.

Firstly, a solid understanding of financial statements is essential for business owners. These statements, including the balance sheet, income statement, and cash flow statement, provide a snapshot of the company’s financial position, performance, and cash inflow/outflow. Analyzing these statements allows entrepreneurs to assess their financial standing, identify trends, and make informed decisions based on accurate financial data.

Secondly, managing cash flow effectively is vital for maintaining the financial stability of a business. Cash flow refers to the movement of money in and out of the company. A positive cash flow indicates that the business is generating more cash than it is spending, while negative cash flow can lead to financial difficulties. By implementing strategies such as optimizing payment terms, monitoring receivables and payables, and managing inventory efficiently, entrepreneurs can ensure a healthy cash flow and mitigate potential cash flow challenges.

Lastly, understanding business tax laws is crucial to optimize tax planning and compliance. Tax laws and regulations vary from country to country, and even within regions. Familiarizing oneself with these laws helps businesses identify eligible tax deductions, credits, and exemptions, thus minimizing their tax liability. Additionally, staying compliant with tax laws helps avoid penalties and legal issues, ensuring a smooth operation of the business.

By gaining a comprehensive understanding of these key aspects of business finance, entrepreneurs can effectively manage their financial resources, make informed decisions, and optimize their financial performance. A thorough understanding of financial statements, cash flow management, and business tax laws lays a solid foundation for mastering the money game and achieving long-term success in the business world.

Navigating Business Tax Law

Understanding and navigating the complexities of business tax law is crucial for any entrepreneur or business owner. With proper knowledge and compliance, you can ensure that your business stays on the right side of the law and minimize the risk of costly penalties.

- Stay Updated with Tax Regulations

Microcaptive

Business tax regulations are ever-evolving, and it is essential to stay updated with the latest changes. Regularly consult reliable sources such as the IRS website or seek guidance from professional tax advisors. By staying informed, you can identify any new regulations that may impact your business and take the necessary steps to comply with them.

- Maintain Accurate Financial Records

Accurate financial record-keeping plays a significant role in navigating business tax law. Keep detailed records of your business’s income, expenses, and deductions. Implement a robust accounting system that allows you to track your financial transactions effectively. This will not only help you during tax filing but also provide transparency and clarity should you ever face an audit.

- Seek Professional Advice

Navigating complex business tax law can sometimes be overwhelming. It is wise to seek professional advice from tax attorneys or certified public accountants (CPAs) who specialize in business taxation. These experts can offer valuable insights and guide you through the intricacies of tax planning, compliance, and reporting, ensuring that you make informed decisions for your business.

By understanding the nuances of business tax law, maintaining accurate records, and seeking professional advice when needed, you can confidently navigate the financial landscape and ensure your business’s financial success. Proper compliance and understanding of tax regulations will allow you to focus on growing your business while staying in good standing with the law.

Strategies for Financial Success

In order to achieve financial success in your business, it is essential to implement effective strategies that can guide you towards your goals. Here are three key strategies to consider:

Clear Financial Goals: It is crucial to set clear financial goals for your business. This involves determining specific targets for revenue, profit, and growth. By outlining these goals, you can create a roadmap for your financial success and establish measurable benchmarks along the way.

Efficient Budgeting: Developing a well-structured budget is essential for effective financial management. Start by evaluating your income and expenses, and allocate funds accordingly. Make sure to prioritize essential expenses while also factoring in potential investments and savings. Regularly review and update your budget to ensure it aligns with your business’s evolving needs.

Embrace Technology and Automation: Take advantage of modern financial tools and technology to streamline your business finance processes. Implementing accounting software, for example, can help you track income and expenses, generate financial reports, and handle payroll efficiently. Automation can save time, minimize errors, and improve overall financial management.

By implementing these strategies, you can pave the way for financial success and ensure the stability and growth of your business. Keep in mind that each business is unique, so it’s essential to adapt these strategies to fit your specific circumstances and goals.