Welcome to our Insider’s Guide to Unlocking Security: Commercial Insurance Demystified. In today’s dynamic business landscape, understanding the ins and outs of commercial insurance is essential for protecting your enterprise from potential risks. Whether you’re a seasoned entrepreneur or just starting out, comprehending the importance of business insurance and implementing effective risk management strategies is the key to safeguarding your financial future.

Commercial insurance plays a pivotal role in shielding businesses against a wide range of potential uncertainties, including property damage, liability claims, and unforeseen disruptions. By transferring these risks to insurers, companies can focus on their core operations with peace of mind. However, navigating through the complex world of commercial insurance can be a daunting task, often coated with industry-specific terminology and intricate policies. That’s where our comprehensive guide comes in, to demystify the intricacies of commercial insurance and empower you to make informed decisions regarding your organization’s risk management. So, let’s dive in and unlock the security that a carefully tailored commercial insurance policy offers.

Understanding Business Insurance

Business insurance is a crucial component of risk management for any company. Whether you own a small startup or a large corporation, having the right commercial insurance coverage can protect your business from unexpected financial losses. Business insurance policies are designed to safeguard your company and its assets, giving you peace of mind and allowing you to focus on growing your business.

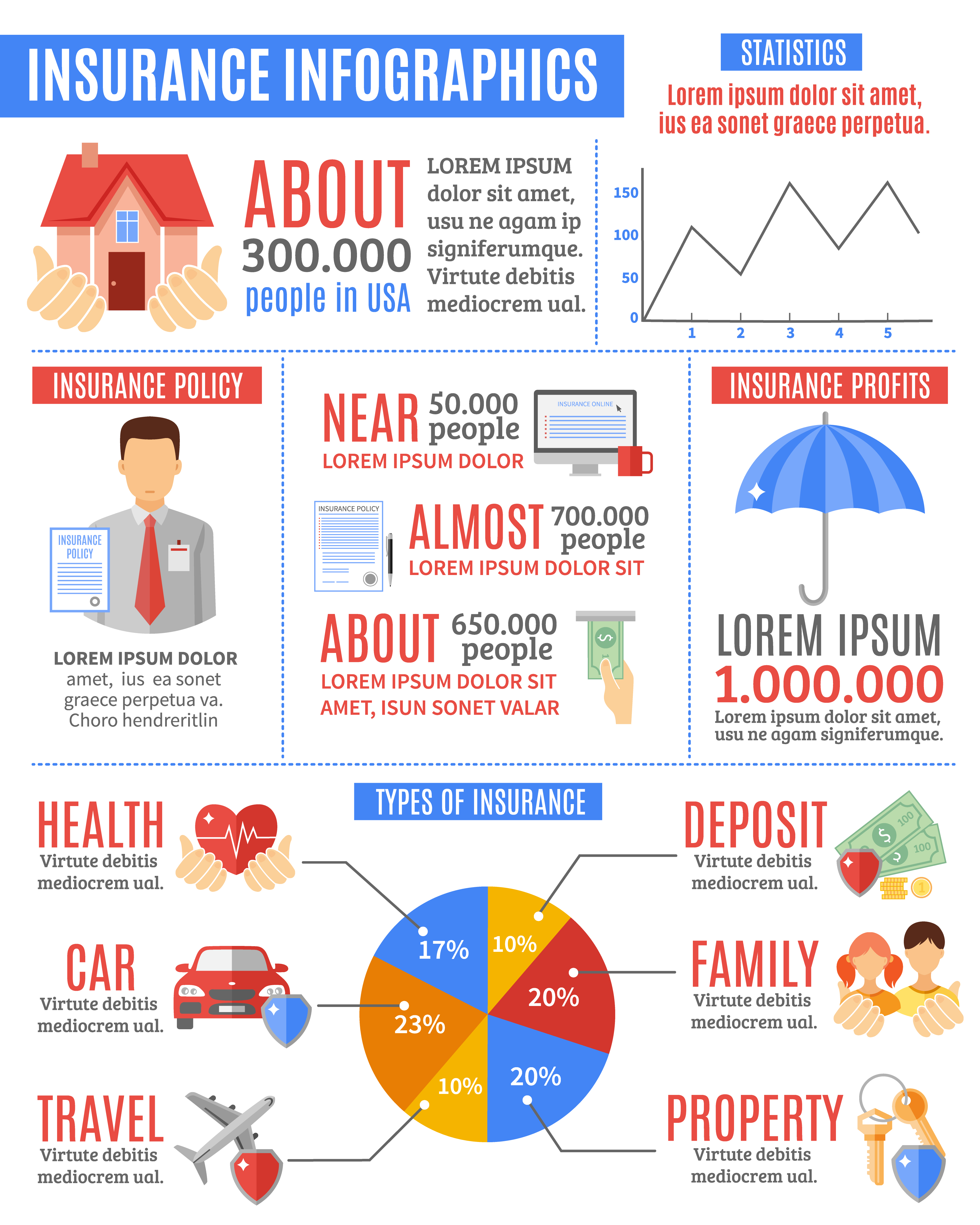

Commercial insurance is a broad term that encompasses various types of coverage tailored to meet different needs. One common type of business insurance is property insurance, which provides financial protection in the event of damage or loss to your company’s physical assets, such as buildings, equipment, and inventory. This coverage is essential for businesses that own or lease property and want to safeguard their investments.

Another important aspect of business insurance is liability coverage. This type of insurance protects your company from legal claims and financial responsibility for injuries or damages caused to others as a result of your business operations. Liability coverage can include general liability insurance, professional liability insurance, and product liability insurance, depending on your specific industry and risks.

In addition to property and liability insurance, there are other types of commercial insurance that may be necessary for your business. For example, business interruption insurance provides compensation for lost income and ongoing expenses if your operations are interrupted due to covered events, like a fire or natural disaster. Workers’ compensation insurance, on the other hand, provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses and lost wages.

Understanding business insurance is crucial for any business owner, as it helps to mitigate potential risks and protect the financial well-being of your company. By evaluating your specific needs and working with a reputable insurance provider, you can find the right commercial insurance policy that fits your business and provides the necessary coverage to unlock security.

Commercial Auto Insurance

Navigating Commercial Insurance Policies

Understanding the ins and outs of commercial insurance can feel overwhelming, but with the right knowledge, you can navigate your way to the best coverage for your business. Whether you’re a small start-up or an established company, having the right insurance policies in place is crucial for protecting your assets and managing risks effectively.

One of the first steps in navigating commercial insurance is identifying the specific coverage your business requires. Commercial insurance policies can vary significantly depending on the industry, size, and nature of your business. It’s essential to assess the risks your business faces and evaluate which policies are necessary to mitigate those risks effectively. Common types of commercial insurance include property insurance, liability insurance, workers’ compensation insurance, and business interruption insurance.

Next, it’s important to thoroughly review and understand the terms and conditions of each insurance policy you consider. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations that may apply. This will help you determine if the policy adequately protects your business and if there are any gaps in coverage that need to be addressed. Consulting with an experienced insurance agent or broker can provide valuable insights and guidance during this process.

Once you have identified the appropriate policies and reviewed their terms, it’s time to compare insurance quotes from different carriers. Requesting multiple quotes allows you to assess the cost and coverage options offered by different insurance providers. Keep in mind that the cheapest option may not always be the best choice. Consider the financial stability and reputation of the carrier, as well as their claims settlement process and customer service.

By following these steps, you can navigate commercial insurance policies with confidence, ensuring your business is properly protected against potential risks. Remember, regular reviews of your coverage and reassessment of your insurance needs are essential as your business evolves and grows. With the right insurance in place, you can focus on what matters most – running and growing your business.

The Importance of Effective Risk Management

Effective risk management plays a crucial role in the realm of commercial insurance. As businesses face an array of risks on a daily basis, having a comprehensive risk management strategy becomes paramount to their success.

First and foremost, having a robust risk management plan helps businesses identify potential threats and vulnerabilities. By thoroughly assessing their operations, businesses can pinpoint areas where they are most exposed to risks. This knowledge allows them to take proactive measures to minimize these risks and protect their assets.

Furthermore, effective risk management enables businesses to make informed decisions regarding their insurance coverage. By analyzing their specific risks, businesses can determine the types and levels of coverage that best suit their needs. This ensures that they are adequately protected without overspending on insurance premiums.

Moreover, implementing a proven risk management strategy can significantly reduce financial losses stemming from unexpected events. By addressing risks before they materialize, businesses can prevent or minimize the damage caused by these events. This not only protects their bottom line but also helps maintain business continuity in the face of adversity.

In conclusion, effective risk management is a crucial aspect of commercial insurance. By identifying and mitigating potential risks, businesses can safeguard their assets, make informed decisions about insurance coverage, and minimize financial losses. Embracing a comprehensive risk management approach is key to unlocking security and ensuring the long-term success of businesses.