Welcome to the Ultimate Guide to Home Insurance! Your home is your haven, a place where you and your loved ones find peace, comfort, and security. However, unforeseen events can disrupt this sense of tranquility, making it vital to protect your most valuable asset with home insurance.

Home insurance provides financial coverage against various risks, including damage or destruction to your property caused by natural disasters, fires, theft, or other unfortunate incidents. In this guide, we will not only explore the importance of home insurance but also delve into the world of commercial auto insurance and life insurance to ensure comprehensive protection for you and your loved ones.

Whether you’re a homeowner or renter, understanding the ins and outs of home insurance is crucial. It offers more than just peace of mind; it provides a safety net that allows you to focus on creating beautiful memories within the walls of your cherished abode. So, let’s embark on this journey together as we uncover the essential details about home insurance, commercial auto insurance, and life insurance – safeguarding your haven has never been more important.

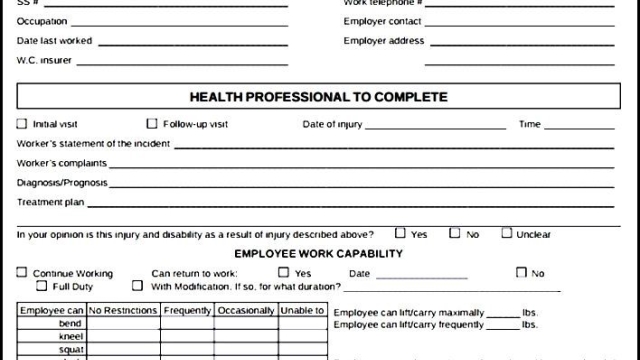

Workers Comp Insurance South Carolina

Understanding Home Insurance

When it comes to safeguarding your haven, home insurance plays a vital role in providing the protection you need. Whether you’re a homeowner or a renter, having the right coverage in place can offer you peace of mind and financial security in case of unfortunate events. Home insurance, sometimes referred to as homeowner’s insurance or renter’s insurance, is a type of policy that covers the property and belongings within your home against a range of risks and perils.

One of the key elements to understand about home insurance is that it typically includes both property coverage and liability coverage. Property coverage helps protect your home and any attached structures, such as garages or sheds, as well as your personal belongings. This means that if your home is damaged or destroyed by fire, natural disasters, theft, or vandalism, your policy can help cover the cost of repairs or replacement of damaged items.

On the other hand, liability coverage is designed to protect you financially in the event someone is injured on your property or you accidentally damage someone else’s property. For example, if a visitor slips and falls at your home and decides to file a lawsuit, your liability coverage can help cover legal expenses and any resulting damages up to the policy limits.

It’s important to note that home insurance policies can vary in coverage and price. Factors such as the location of your home, its value, and your desired level of coverage will influence the cost and specific terms of your policy. To ensure you have the right protection for your haven, it’s recommended to shop around, compare quotes from different insurance providers, and thoroughly review the terms and conditions of each policy before making a decision.

Exploring Commercial Auto Insurance

When it comes to protecting your business assets, commercial auto insurance is an essential coverage to consider. As a business owner, you understand the importance of keeping your vehicles safe and insured. With commercial auto insurance, you can safeguard your company’s automobiles, trucks, and vans against any unforeseen accidents or damages that may occur while on the road.

Not only does commercial auto insurance provide coverage for physical damages, but it also extends protection for liability. This means that in the event of an accident where you or one of your employees is at fault, the insurance can help cover the costs associated with property damage or bodily injuries to the other party involved. This coverage is crucial for businesses that heavily rely on transportation to carry out their operations.

Moreover, commercial auto insurance offers additional benefits such as coverage for theft, vandalism, and even natural disasters. Having this added layer of protection ensures that your vehicles and your business can quickly recover from any unforeseen circumstances that may arise. By insuring your commercial vehicles, you can have peace of mind knowing that your hard-earned assets are safeguarded.

In conclusion, commercial auto insurance plays a vital role in protecting your business vehicles and ensuring the smooth operation of your company. By providing coverage for damages, liability, theft, and more, this insurance allows you to focus on growing your business without worrying about the financial and legal consequences of any unfortunate incidents on the road. Invest in commercial auto insurance and protect your business assets today.

Importance of Life Insurance

Life insurance is a critical component of financial planning for individuals and their families. It provides a safety net that ensures loved ones are taken care of in the event of an unexpected tragedy. Having proper life insurance coverage can bring peace of mind, knowing that financial burdens will be alleviated during challenging times.

One of the key benefits of life insurance is the protection it offers to dependents and beneficiaries. In the event of the policyholder’s untimely death, the life insurance payout can provide financial support for everyday expenses, such as mortgage payments, school fees, and healthcare costs. This ensures that loved ones can maintain their quality of life and continue to pursue their dreams and aspirations.

Life insurance also acts as a safeguard against any outstanding debts the policyholder may have. Whether it’s a mortgage, personal loans, or credit card debt, life insurance can help cover these financial obligations, preventing them from becoming a burden on family members or other survivors.

Moreover, life insurance can be a valuable tool for estate planning. It can provide liquidity to cover estate taxes and other expenses, ensuring a smooth transfer of assets to beneficiaries. This can prevent the need to sell valuable assets hastily, allowing families to maintain their financial stability and preserve their wealth for future generations.

In conclusion, life insurance plays a crucial role in protecting the financial well-being of individuals and their families. It provides a safety net during difficult times, offers support for dependents, covers outstanding debts, and aids in effective estate planning. By securing the right life insurance coverage, individuals can have peace of mind, knowing that their loved ones will be taken care of financially when they need it most.