When it comes to protecting our homes, most people immediately think of home insurance as a way to safeguard their property against unforeseen events such as fires, theft, or natural disasters. And while that is undoubtedly one of the primary purposes of home insurance, there are hidden benefits that often go unnoticed. Home insurance not only provides financial protection for your dwelling, but it also extends its coverage to the people living within its walls.

Commercial Auto Insurance

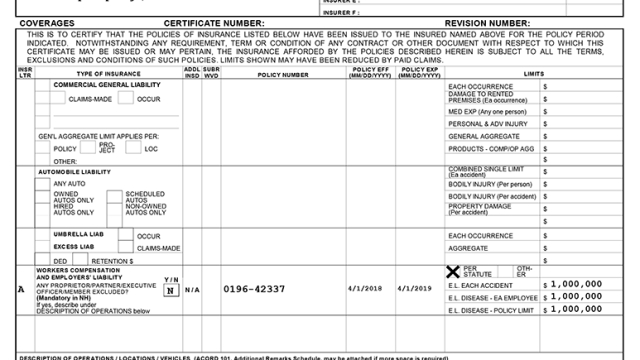

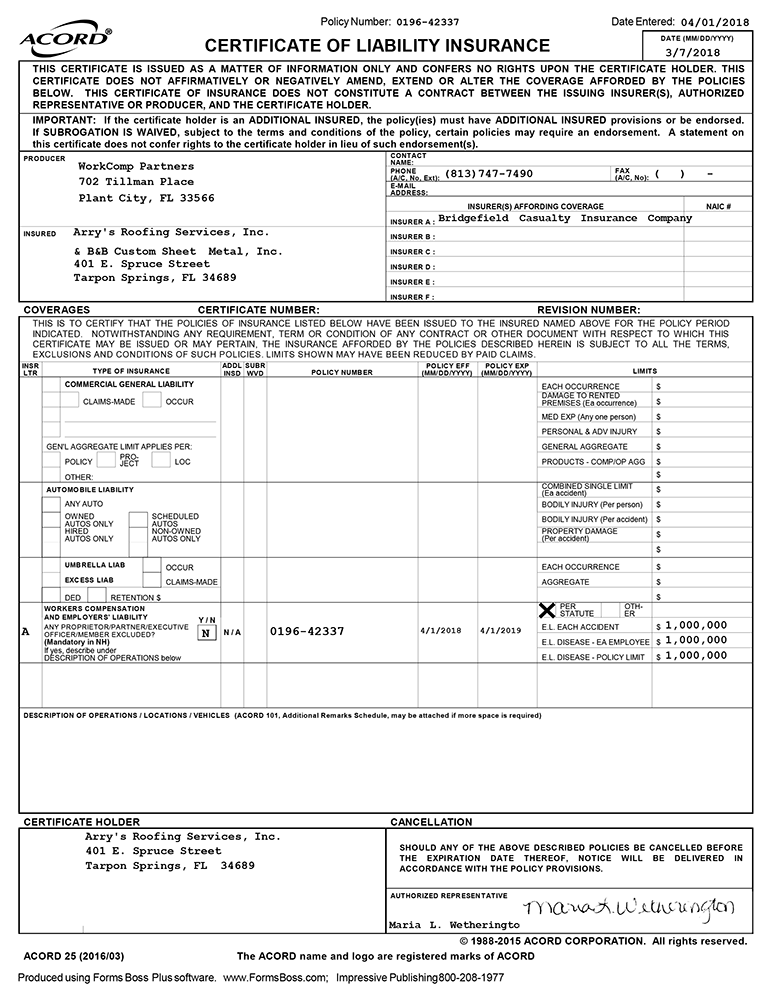

A comprehensive home insurance policy offers a range of protections, one of which is workers’ compensation insurance. This type of coverage is designed to provide assistance to any domestic employees working in your home, such as nannies, housekeepers, or gardeners, in the event that they suffer from work-related injuries or illnesses. Without this safeguard in place, you, as the homeowner, could potentially be held liable for any medical expenses or lost wages incurred by your employees. With workers’ comp insurance included in your home insurance policy, you can ensure that your valued staff receives the necessary support and medical care they may require in such unfortunate situations.

Additionally, home insurance policies often include general liability insurance, which can protect you from financial responsibility if someone is injured while on your property. Whether it’s a guest slipping and falling on a wet floor or a delivery person tripping over an object, accidents can happen unexpectedly. With general liability insurance, any resulting medical expenses or legal fees can be covered, so you don’t have to bear the financial burden yourself.

Moreover, if you are planning any home improvement or renovation projects, having contractor insurance as part of your home insurance package is crucial. This type of insurance provides coverage for any liability or property damage that may occur during the project. Whether it’s a mishap with heavy machinery or unintentional damage caused by the contractor, having this coverage ensures that you won’t be left financially responsible for unforeseen circumstances that can arise from construction work.

As homeowners, it’s essential to recognize the full breadth of protection that home insurance offers beyond safeguarding our property. By understanding and utilizing the hidden benefits, such as workers’ comp, general liability, and contractor insurance, we can truly take care of not only our homes but also the people and circumstances within them.

1. Protecting Your Employees with Workers Comp Insurance

One of the lesser-known benefits of home insurance is its ability to provide protection for your employees through workers comp insurance. When you run a business from your home, it’s important to remember that accidents and injuries can occur, even in a seemingly safe environment.

By having workers comp insurance as part of your home insurance policy, you can ensure that your employees are covered if they are injured while working for you. This insurance provides benefits such as medical expenses, disability payments, and even rehabilitation costs, helping your employees get the necessary support and care they need to recover.

Should an employee suffer an injury while on the job, workers comp insurance not only protects your employees but also provides you, the homeowner and employer, with peace of mind. It can help prevent costly lawsuits and legal battles that may arise from workplace injuries, ensuring that both parties are protected in case of an unfortunate incident.

Having adequate coverage for workers comp insurance as part of your home insurance policy is crucial, especially when considering the potential risks and liabilities that come with running a business from your home. It’s always better to be prepared and protected, both for the sake of your employees’ well-being and your own long-term financial security.

2. Safeguarding Your Home and Belongings with Home Insurance

When it comes to protecting your most valuable assets, such as your home and belongings, home insurance is a key safeguard. Home insurance provides financial coverage and security in case of unexpected events such as fire, theft, or natural disasters.

One of the main benefits of home insurance is the protection it offers for your physical property. Whether you own a house or condominium, home insurance covers the cost of repairing or rebuilding your property in case it gets damaged by covered perils. This means that if your home is damaged by a fire, for example, your insurance policy can help cover the costs of restoring it to its pre-damaged state. Without home insurance, you might face significant financial burdens to rebuild or repair your property.

Additionally, home insurance extends its coverage beyond just the physical structure of your home. It also includes coverage for your personal belongings. If your belongings are stolen or damaged, your insurance policy can help reimburse you for the cost of replacing them. This can provide a sense of relief knowing that even if the unexpected happens, you have a safety net to fall back on.

Furthermore, home insurance often includes liability coverage. This means that if someone gets injured on your property and you are found legally responsible, your insurance can help cover the associated medical expenses or legal costs. This can prevent a potentially large financial burden from falling onto your shoulders.

In conclusion, home insurance provides a comprehensive safety net for safeguarding your home, personal belongings, and even your financial well-being. It offers protection against unexpected events, ensuring that you can recover and rebuild without being left with significant financial burdens. From protecting your physical property to covering the costs of replacing stolen or damaged belongings, home insurance offers peace of mind and security.

3. Shielding Your Business with General Liability and Contractor Insurance

Home insurance not only protects your property, but it can also provide valuable coverage for your business. If you run a small business, such as a contracting company, having the right insurance coverage is essential to safeguarding your livelihood and protecting against unexpected risks.

General liability insurance is a crucial component of any comprehensive business insurance plan. It shields your business from the financial burden of potential third-party claims, such as bodily injury or property damage caused by your business operations. Accidents can happen, even in the most careful of environments, and having general liability insurance ensures that you are protected from potential lawsuits and costly legal expenses.

Contractor insurance, on the other hand, specifically caters to professionals in the construction industry. As a contractor, you face unique risks and responsibilities while working on projects. Contractor insurance provides coverage for property damage, personal injury, and even Workers’ Comp Insurance, ensuring that you and your employees have the necessary protection while on the job.

By insuring your small business with general liability and contractor insurance, you can focus on what you do best – providing quality services to your clients. The peace of mind that comes from knowing your business is safeguarded against unforeseen events is invaluable, allowing you to concentrate on growing and developing your company. With the right insurance coverage in place, you can confidently take on new projects, secure in the knowledge that your business is protected.